Web3 Risk Intelligence for Financial Institutions

Crypfy delivers blockchain intelligence for risk management, compliance, and antifraud — serving both Web3-native platforms and regulated TradFi actors navigating digital asset environments.

As digital assets and decentralized technologies mature, financial institutions face increasing exposure to operational, regulatory, and reputational risks. Crypfy bridges this gap by delivering structured, reliable, and explainable intelligence across Web3 ecosystems.

Speak with our specialists about your operational requirements.

Brand Monitoring

ActiveTrusted by Financial Institutions and Anti-Fraud Leaders

Crypfy works alongside regulated organizations, compliance teams, and risk professionals who require accuracy, transparency, and operational reliability. Our strategic partnership with AlfaGroup — the leading anti-fraud organization in Italy — combines decades of financial expertise with advanced Web3 intelligence capabilities.

Platform and Services

Structured intelligence across wallet risk, brand protection, and advisory services.

Wallet Risk Intelligence

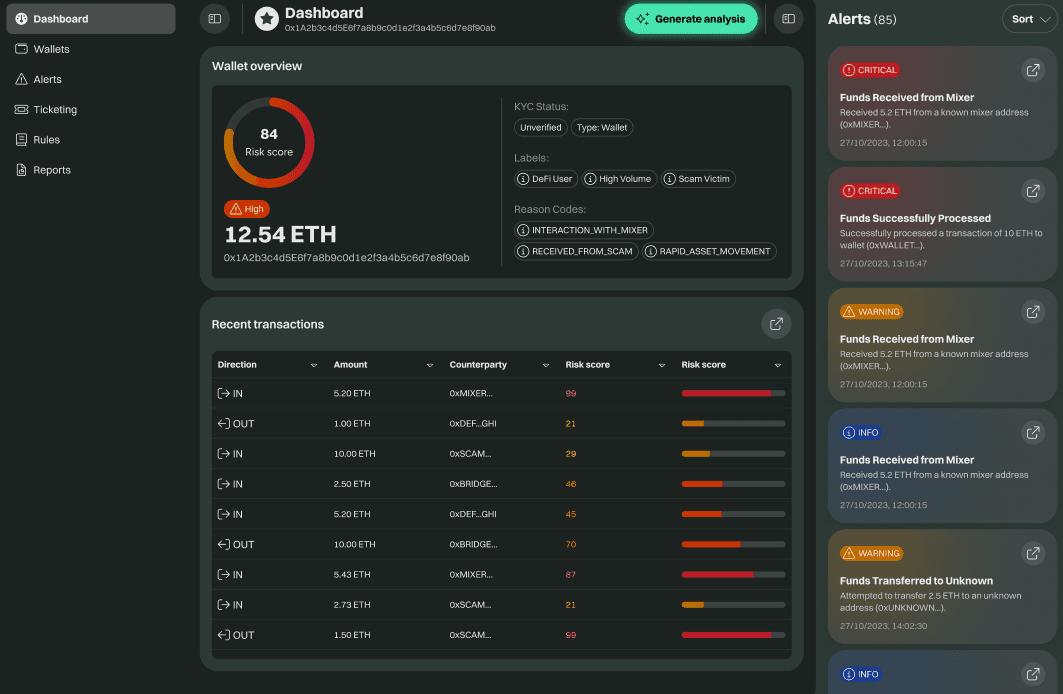

Structured risk analysis for blockchain wallets and transactional behavior, built for institutional compliance workflows.

Web3 Brand Protection

Continuous monitoring and threat detection across decentralized naming systems and digital identities.

Wallet Scoring for Credit Loans and Cards

On-chain risk scoring to support credit decisioning for banks, lenders, and card issuers.

Advisory and Consulting Services

Strategic guidance to help organizations navigate Web3 compliance, risk frameworks, and regulatory requirements.

Why Crypfy

Discuss Your Risk and Compliance Requirements

Schedule a confidential consultation with our specialists to explore how Crypfy can support your operational and regulatory objectives.